Bond

At the start of a tenancy, a proprietor can ask for up to 2 weeks' rent as a bond - a receipt must be given to the resident within 48 hours of receiving the bond, even if this was paid directly into a bank account

Residents may be eligible for assistance with paying bond and rent.

Lodging a bond

A proprietor must lodge a bond with Consumer and Business Services (CBS) within 2 weeks of receiving the money from the resident, or within 4 weeks if a registered agent manages the property.

Bonds paid before 9 May 2015 didn't have to be lodged with CBS.

Bonds can be lodged online through the Residential Bonds Online service.

Bond guarantee

A bond guarantee provided by Housing SA must be receipted and lodged with CBS before the 'to be lodged by' date it is issued.

The guarantee form must be signed by all parties to the bond. An unsigned guarantee form will not be accepted by CBS.

Claiming and refunding a bond

The bond belongs to the resident. At the end of the tenancy, unless the proprietor has a claim against the bond, it must be returned to the resident or to Housing SA (if they paid the bond on the resident's behalf).

A proprietor can claim all or part of the bond if:

- the resident's in rent arrears

- there are outstanding charges for services and facilities provided under the rooming house agreement

- the resident or their guest caused damage to the property

- the room isn't left in a reasonably clean condition.

When claiming for cleaning or repair of damage caused by a resident, the proprietor must take into account the condition of the property at the start of the tenancy. For instance, it would be unreasonable to claim the full cost of painting a room if the room was last painted several years before the resident moved in.

Residents have the right to dispute any claims against the bond.

At the end of a tenancy, a resident moving to another country can keep their Australian bank account open so their bond refund can be paid into that account. If they want it paid into an overseas bank account, they'll need to lodge an International Money Transfer with CBS. The overseas bank may charge a fee.

Bonds can be refunded online through the Residential Bonds Online service

Rent

At the start of a tenancy, a proprietor can ask for up to one week's rent in advance - a receipt doesn't have to be given if the resident pays rent directly into a bank account.

Residents may be eligible for assistance with paying bond and rent.

Rent receipts and records

A proprietor must give a resident a receipt within 48 hours of receiving a rent payment, unless it's paid directly into a bank account.

A detailed record of all rent paid must be kept by the proprietor. The date the money is credited into the account is the 'paid' date.

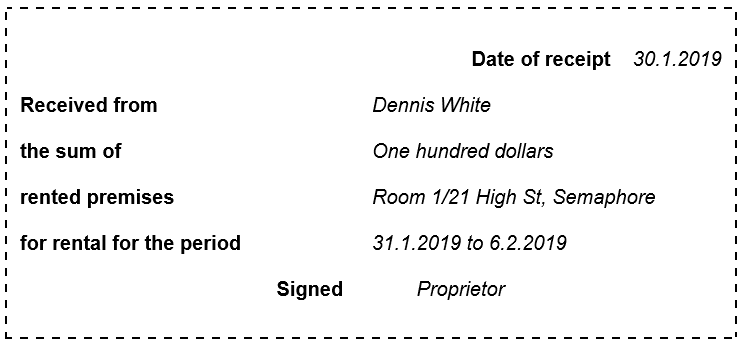

Rent receipts and records must show the:

- date the payment was received

- name of the person who made the payment

- amount paid

- address the payment relates to

- period the payment relates to.

An example of a proper rent receipt/record:

Changing the rent

Increasing the rent

Rent can only be increased once every six months from the date the resident moved in or from the last rent increase.

A proprietor must provide residents with at least 4 weeks' written notice of a rent increase that shows the new rent amount and the date it applies from.

The rent can't be increased under a fixed term rooming house agreement unless a specific condition is included in the agreement.

If the amount of the rent increase and the date it starts is specified in the rooming house agreement, written notice doesn't have to be given.

Rent can't be increased if there's a housing improvement order on the property, until the order has been lifted. Once the order is lifted rent can be increased by giving the correct notice:

- within 4 weeks of an order being lifted – 14 days written notice

- more than 4 weeks after an order is lifted – 4 weeks written notice

Reducing the rent

Rent can be reduced at any time by agreement. This can be a temporary arrangement and if so, residents should be made aware of the date rent will revert back to the original amount.

Other fees and charges

At the start of a rooming house agreement a proprietor must give the resident a written notice that clearly shows which services or utilities they'll be charged for and how these charges will be calculated.

A resident can't be charged for a service they weren't told about. All details should be included in the rooming house agreement.

Service charges

A proprietor can charge a resident for:

- electricity

- water supply

- gas

- telephone

- internet

- laundry

- meals.

A proprietor must give a resident a receipt within 48 hours of receiving a payment for services, unless it's paid directly into a bank account. If requested by the resident, a proprietor must provide a statement detailing information of the payment within 7 days.

Things a proprietor can't charge for

A proprietor can't charge for:

- council or sewerage rates

- the emergency services levy

- taxes.

Contact CBS Tenancies

Email: ocbatenancyadvice@sa.gov.au

Phone: 131 882

Post:

GPO Box 965

Adelaide SA 5001